The “daily payment” of a merchant cash advance can totally kill your cash flow and put you out of business – but there’s a way out…..

Here is how it happens, using an actual example:

One month cash was tight.

All you needed was $12,000 dollars for your business to make ends meet.

That would be plenty and provide a cushion.

You called your bank, they said “… sure, come on down, fill out some forms and we should know in 2 weeks….”

You put it on your schedule.

You went on-line but there were so many options that you decided to look later.

And then someone calls

They’ve called before but you politely said no – but today you listen and they say:

“…we believe in small business….we have money to lend – we make it super simple, how can I help you today?…”

And you say: “as a matter of fact, I do need $12,000, what do I need to do?”

Answer: Just send 3 months of bank statements.

You email the statements and the sales person calls back in 60 minutes and says: Congratulations, you’re approved!

Of course you ask about the terms and hear: “the payback is $232 dollars a day for 75 business days.”

When you asked about the rate, the answer was: “it’s a “buy rate” of 1.45 and we can have the money in your account tomorrow AND once you are in this loan and paying for 30 days, you’ll qualify for a traditional term loan!”

BTW, that’s a fib, there’s no term loan in 30 days.

Forms show up, you initial them electronically, provide a few more things and presto, $12,000 shows up in your account the next day.

Amazing….

Yes it seemed a little expensive but they did solve an immediate problem.

In a month, you notice that your account is bouncing because almost $5500 has gone out to pay this loan off already – And later, you realized that the cash advance almost put you out of business for good.

Welcome to the world of Merchant Cash Advance tele-marketing

If this happened to you, don’t feel bad – about a million other businesses did the same thing in the last few years. If you want to learn how to get out of these types of loans, we’ll tell you how to do it and what it takes 855-708-2672

OK, now let’s stop and see what happened!

Spoiler: This actual MCA Loan had an equivalent APR of 135% ! ….. but keep reading…….

Here is how it works

You get $12,000

You pay back $17,400

Daily Payment $232.00

Number of days 75

On the surface it is a 45% interest rate ($12,000 x 1.45 = $17,400)

$232.00 x 75 days = $17,400

The 1.45% is what they called the “buy rate” or factor rate.

So if you are paying 45% for a 4 month loan, then, the equivalent yearly APR is about three times that, or 135%.

So that’s how we get to an equivalent APR of 135 percent!

It’s the Daily Payment that is the first trap.

$232 dollars per day looked low in the scheme of things but it adds up fast!

Let’s say the $12,000 hit in your account on a Monday – the daily payment starts the next day! If you are open 5 days a week, they have already taken $1160 back by the next Tuesday or Wednesday! Or $1392 if you are open 6 days a week!

So how was the daily payment set?

Most “Funders” use 22-24 operating days per month to calculate the daily payment.

That’s the number of days the business is actually open per month.

The problem is that a small business is primarily sold on the “daily payment”,

But it’s just a number that sounds reasonable [ to get the $12,000 right away and with little paperwork ] at the time.

There’s another misleading number on the loan documents too.

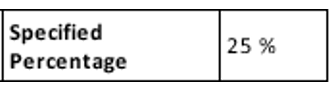

A lot of loans we see highlight something called the Specified Percentage Rate.

Here’s one, right off an mca document:

It actually looks better than the “Buy Rate” of 1.45, doesn’t it?

It is printed big.

But what is it?

It’s just a percentage of daily receipts. It’s a nothing number!

It’s the percentage of daily sales that they are going to take.

In this case that’s the $232 per day!

Who can give up 25% of their daily receipts for $12,000 dollars?

And what does it really have to do with the terms?

This number is displayed prominently to throw off the borrower.

There is another real Trap to be wary of too! Maybe the worst of all!

……………………. Remember the 75 days?

A big sales point for these types of loans is that: …. if sales decline, the percentage you need to pay back daily declines.

but that lengthens the term, which makes the loan even more expensive!

Technically, if you lower the daily payment enough, you could turn it into a perpetual loan at 135% a year, for years.

That’s not helping small business.

That’s Death By Daily Payment.

Here’s the way out – get a third party to intervene – one that has clout and a reputation for straight forward negotiations, one with a proven track record; one that knows laws state by state and collections, industry by industry, like Corporate Turnaround.

Warning! If you call the creditor yourself, you might get a brief respite – but you are then extending the loan and lowering payments, which dramatically increase the amount you pay back! That’s not negotiating!

Read this to learn how to prepare and what to expect on a consultation with a negotiator

855-708-2672 EST