A merchant cash advance is typically marketed using “factor rate” or a “buy rate”, to express the cost of the loan.

Business owners, looking to borrow money, normally think in terms of the Percentage Rate [%] of the loan and the Annualized Percentage Rate [APR], or the yearly cost.

These new and unfamiliar terms [ the factor rate and the buy rate ] can confuse the borrower.

Example:

A merchant cash advance company calls and offers money at a factor rate of 1.30.

In this example the factor rate means that you multiply the money you are getting by 1.30 to come up with the amount of money you are paying back. So, at a rate of 1.30, it looks like the borrower is paying back 30% more than they received in principle.

But…

The key question is this: How long is the term?

These [MCA’s] are like short term loans, so if the term is 12 months, the pay back is 30% more than is loaned or advanced.

But if the term is months the payback is at an equivalent interest rate of 60%.

And if it is 3 months it is 90%.

Unlike a traditional loan, “advance” interest is charged at the beginning on the entire balance. On a standard loan, you pay interest on a declining balance as you pay down principle.

Things can become more confusing in comparing different offers. One lender may offer money at a factor rate of 1.25 for 3 months and another might simultaneously offer a buy rate of 1.33 for 6 months.

Let’s take a look at the difference using $35,000 as the advance figure:

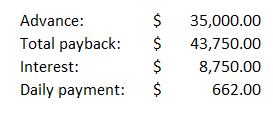

$35,000 for 3 months [66 days] at a factor rate of: 1.25

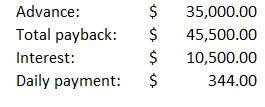

$35,000 for 6 months [132 days] at a factor rate of: 1.33

In these examples, a merchant who needs fast cash, might choose the six month option, only because the daily payment is much lower, overlooking the fact that is a loan at 66% interest!

What business can afford these rates? Not many that we know. And the commissions to telephone sales people are very high, hence the enthusiasm and “availability” of money.

A business owner needs to very careful in evaluating the high costs of these loans. If you need help calculating the real cost of your advances, or need to negotiate new terms because the rates are putting the survival of your business in jeopardy, just give a call or send us an email.