Corporate Turnaround has worked closely with the NJSBDC [New Jersey Small Business Development Centers] for over ten years. In that time, we [ Corporate Turnaround and www.DontDeclare.com ] have helped the SBDC and ASBDC counsel small businesses in New Jersey and across the nation after Hurricane Sandy, The BP Oil Spill and now the Corona Virus.

We are “overflow” counselors for the NJSBDC. Our job is to help the NJSBDC prioritize and assess the nature of your current business challenges and help you determine what aid and counseling help is available, including the new SBA loans that are being authorized. SBA loans are often low interest, long term loans to help small business survive a crisis.

In order to receive counseling from the NJSBDC, it is necessary to fill out their SBA [Small Business Association] “Request for Counseling” form also known as Form 641. This will get you in the system as a business that is requesting help from the NJSBDC [and the SBA] due to the COVID-19 Virus.

It’s really easy to fill out the form, it is not a complicated.

To fill out Form 641 click here and new window will open: Fill Out Form 641. When you are done, come back and read the most up to date information we have, below.

Updates

Update 4/8/2020: NJ SBA warns that there are many scams out there posing as legitimate entities. They say check the URL, if it does not end in .gov, it is not SBA or Treasury. Also Treasury put out a comprehensive web page today talking about the PPP loan, find it here.

Update 4/6/2020: The Chambers of Commerce put out an excellent guide.

Update as of 4/6/2020: Al Titone of the NJ SBA is offering very current updates on LinkedIn. Today’s update is Here He strongly asks all to read his Friday update too: Here

Update as of 4/3/2020 The PPP program is live. Bank of America seems to be the only major bank with a portal up and active.

Update as of 4/2/2020 The PPP or Pay Check Protection Program is not available yet, it is expected to be available on Friday 4/3/2020.

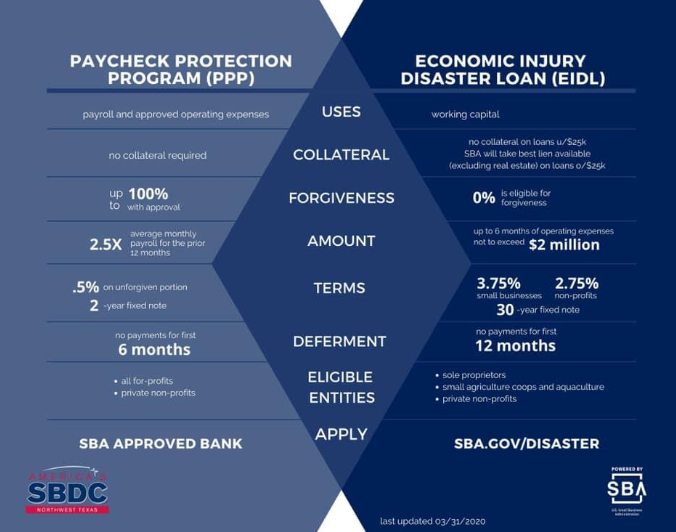

Update as of 4/1/2020 The SBA has many types of loans. Right now they are focusing on 2 loans to help small business through the Covid-19 crisis. The first is a disaster loan and it is available now. Click here for the site to apply for this loan. Here is a PDF about applying for the loan on-line. It is only available directly from the SBA. Make sure you also apply for the $10,000 grant.

There is also a second loan package called the “PPP” or Paycheck Protection Program. It will be available at banks and SBA approved lenders. That loan should be available hopefully by the end of the week. This loan is meant to fully cover all costs, including social security, medical and insurance, of keeping your employees on board for 2 1/2 months. It will also cover rent, utilities and mortgage interest. They’ll be asking for an estimate of what it will cost and will want verification in order to forgive the loan. You’ll also need to use the money within 8 weeks of receiving it. As of 4/2/2020, that loan is not available. Forbes wrote a clear article on this – see Forbes.

Here is what the application looks like – don’t fill this out but use it as a guide for what you will need when it becomes available.

On March 31st 2020, the NJ SBA had an excellent webinar. Here is what I learned:

They suggested that you apply for anything and everything because: 1) the worst that can happen is you get turned down and 2) applications with the SBA will not affect or ding your credit profile. They also said that the “Disaster loan”, also known as EIDL, pronounced “IDLE” if you hear it, will automatically send applicants $10,000, so that’s a reason to apply. They stressed that you should not have the same “use of proceeds” listed on each loan application because they are different loans. One is for Payroll and the other is for other expenses, including rent, leases and supplies. Another suggestion is to visit the NJ Economic Development Authority [NJEDA] or the economic development offices of your state because there are other grants available [ note: the SBA does not offer grants]. Here is a link to New Jersey’s information hub for Covid 19.

Another point the SBA made is this: The SBA offers loans and a loan is offered based on the ability to repay, so you need to have revenues. Use 2019 revenues, be reasonable [ and they will probably be reasonable too]. One last note, there are 350 billion dollars available – that’s a lot of money – so don’t pull your hair out filling the forms tonight but don’t put it off too long either.

They also mentioned that the SBA site has already been revamped to handle the increased traffic and if somehow you apply twice by mistake, don’t worry, they should catch it on their end. [Amended, but try not to as it will increase traffic and add to any bottle-necks that exist]

If you have questions, write me at the email below. If you are being crushed by current debt talk to one of our experts here.

Here is a great graphic from the Association of Small Business Development Centers to help differentiate the loans.

If your issue is directly related to the business debt you are carrying, or high interest merchant cash advances, click the button below this to speak with one of our business debt management experts. This conversation is completely free and will help you explore all of your options.

To learn more about Corporate Turnaround, click here to visit DontDeclare.com